haven't done my taxes in 3 years

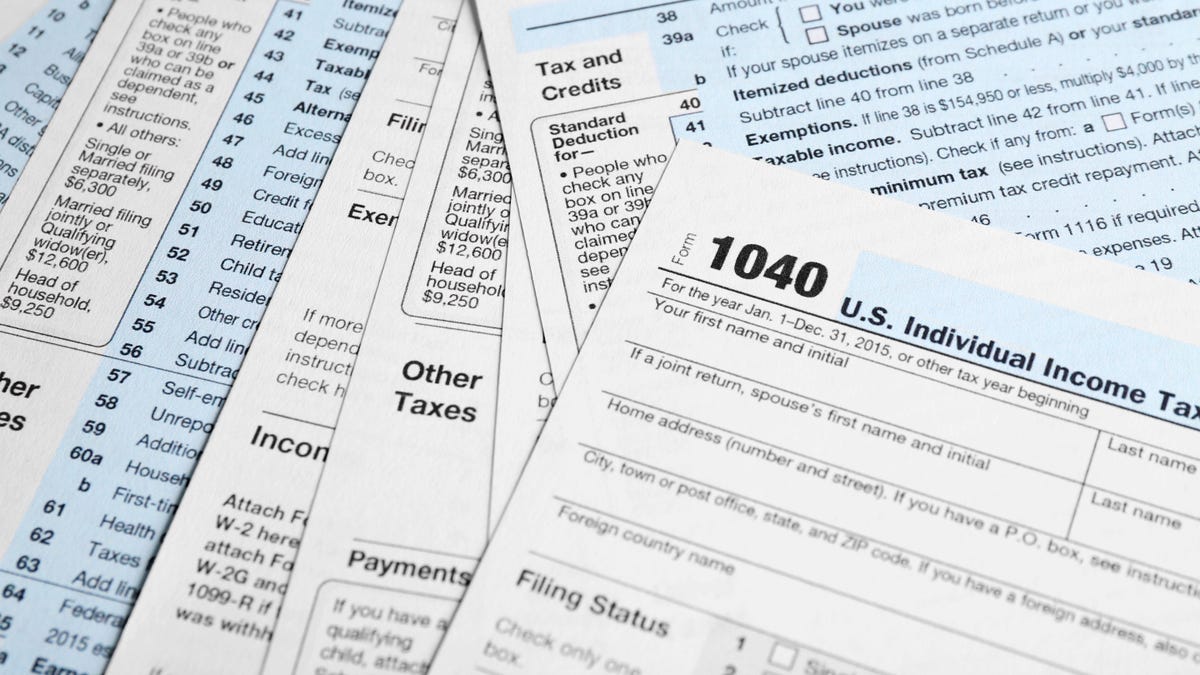

Before April 15 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. You only have 3 years from the original due date of the tax return to claim.

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Hello pf this is my first time posting here.

. After April 15 2022 you will lose the 2016. Underpayment penalty 05. Approximately 70 million Americans will see a 87 increase in their Social Security benefits and Supplemental Security Income SSI payments in 2023.

See if youre getting refunds. And I have not filed my taxes in 3 years. Havent Filed a Tax Return in 3 Years If You Are Due a Refund.

The IRS enforcement capabilities have increased with advances in technology. If you have missing tax returns - and you were required to file for these tax years - then you do not have any choice but to file. After May 17th you will lose the 2018.

The state can also require you to pay your back taxes. We can help Call Toll-Free. Havent done my taxes in 3 years and I dont know where to start.

An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. I havent done my taxes in 3 years even though i always get money back will i lose my oldest year if i dont file - Answered by a verified Tax Professional.

They will want to verify who you are so youll need your name address social security number employer and current salary said. Also because of not filing - you might missed. After the expiration of the three-year period the refund statute.

Capture Your W-2 In A Snap And File Your Tax Returns With Ease. Rememberonce its been three years from the due. If you dont file within three years of the returns due date the IRS will keep your refund money forever.

If you require more assistance then avoid the chain stores and find a local Enrolled Agent or CPA office to assist you. It felt low to me. If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation.

Theyre pursuing unfiled returns much faster than was previously the case. Its possible that the IRS could. That late fee does cap at 12.

We use cookies to. I had a conversation with my boss yestarday and I casually mentioned it not thinking. The first step in getting out of your tax mess is calling the IRS.

If you havent filed. What happens if you havent done your taxes in 3 years. Im 24 years old single.

If youre late on filing youll almost always have to contend with these two penalties. Failure to file penalty 5 of unpaid tax per month. Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000.

See if youre getting refunds. At three years this is your last chance to claim your tax refund money.

I Haven T Paid My Taxes In 3 Years Single By Ses Pul Spotify

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

How To Fill Out The Irs Non Filer Form Get It Back

Taxes 2022 Here S How To Get A Filing Extension From The Irs Cbs News

What Happens If I Haven T Filed Taxes In Years H R Block

Never Pay Taxes Again Go Curry Cracker

Tax Day Is Today What Experts Want You To Know If You Haven T Filed Nextadvisor With Time

Can T File Your Tax Return By Midnight Here S How To File A Tax Extension Cnet

If You Filed For A Tax Extension You Have Until October 17 To File Here S Why You Shouldn T Wait Nextadvisor With Time

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

What Is The Penalty For Not Filing Taxes Forbes Advisor

Unfiled Tax Returns Guidelines And Info On Filing Tax Returns Late

Irs Notice Asking Me To Confirm That I Filed My 2021 Federal Taxes I Haven T Filed R Tax

What To Do If You Haven T Filed Your Taxes In Years

Anthony Bourdain Owed 10 Years Of Taxes